alabama delinquent property tax phone number

Once your price quote is processed it will be emailed to you. Taxes are due October 1.

Shelby County Alabama Property Tax Commissioner Tax Lien Information Site

Jefferson County Tax Collector Tax Collector Property taxes are due October 1 and are delinquent after December 31 of each year.

. Contact Us General Information Alabama Department of Revenue 50 North Ripley Street Montgomery AL 36104 Motor Vehicle Division 2545 Taylor Road Montgomery AL 36117 Taxpayer Service Centers You can now Schedule your Appointments Online Have a Question. Once you have found a property for which you want to apply select the cs number link to generate an online application. Tax Delinquent Properties for Sale Search You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State.

When contacting Wilcox County about your property taxes make sure that you are contacting the correct office. A You may come to the Revenue Commissioners Office at the courthouse and make payment in person by cash check or money order. To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division.

B You may pay by mail with check or money order to. Revenue Commissioner - 3346774747 Appraisal - 3346774718 Mapping - 3346774755 Business Personal Property - 3346774757 Assessing - 33346774753 Manufactured Homes - 3346774758 Collections - 3346774715 Chief Clerk - 3346774714 E-Mail Us. Hwy 31 S Bay Minette AL 36507.

Stats Fastest-growing counties in Alabama 9. The fee for the Title Application is 1800. Accurate records must be kept at all times since this office is involved in the.

October 1 Taxes due January 1 Taxes delinquent February Turned over to Probate 1 Probate. Home FAQ Contact Us. 260 Cedar Bluff Rd Suite 102 Centre AL 35960 256 927-5527 FAX 256 927-5528 c Pay property tax online.

Jeff Arnold Jackson County Revenue Commissioner PO. The lien date for taxes is October 1 and taxes are due the following October 1. Always write your assessment number and account number on the check.

Select your County to pay your property taxes. Alabama Delinquent Property Tax Phone Number. When using a social security number mask the number using the following format.

All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. Search Baldwin County real property and personal property tax and appraisal records by owner name address or parcel number. Check back regularly - were loading county lists as they become available so stay tuned.

Tax Delinquent Property and Land Sales About You may request a price quote for State held tax delinquent property by submitting an electronic application. Property Tax Alabama Department Of Revenue. All property tax other than public utility is assessed and collected through the 67 county tax offices.

The Property Tax Division makes the Book of Lands available for purchase and open for public inspection between 800 AM and 500 PM Monday through Friday except holidays. Payment may be made as follows. Alabama Department of Revenue.

Information Regarding Delinquent Property Taxes Beginning on January 1st interest and fees accrue on delinquent property taxes. Created by Lina Castro on Dec 30 2020. Your one stop for Alabama Property Tax Payments.

The 2022 Alabama Auction season is in full swing. Number of parcels per map this number identifies which block on the. And work with the sheriffs office to foreclose on properties with delinquent taxes.

There is a convenience fee for using a card. Baldwin County Revenue Commissioners Office. Wilcox County Assessor Phone Number 334 682-4625.

Checks or money orders should be made payable to the Alabama Department of Revenue. The Tax Collectors Office is responsible for. Box 327210 montgomery al 36132-7210 334 242-1525 alabama department of revenue application for purchase of land sold to state of alabama for delinquent taxes adv.

Taxes are due every october 1 and are delinquent after december 31st. The convenience of paying from your home work or anywhere that you have access to the internet. Taxes are due every october 1 and are delinquent after december 31st.

If you have any questions contact a Revenue Compliance Officer by calling 334 353-8096. Tax sale lists are updated daily to keep them fresh and to give you a head start on your auction research. Union Street Suite 980 Montgomery AL 36132-7210.

View and print transcripts of tax delinquent properties available for purchase. This gives you the ability to pay your property taxes at your convenience anytime day or night. The interest is equivalent to 1 of the tax per month plus a delinquency fee of 5.

Transcript of tax delinquent land available for sale 2753 mobile state of alabama-department of revenue-property tax. You are given ten calendar days. 307 Scottsboro Alabama 35768.

Collecting all Real Estate Property taxes. Norris REVENUE COMMISSION CLARKE COUNTY ALABAMA CONTACT INFORMATION REVENUE COMMISSIONER OFFICE 114 Court Street Grove Hill ALABAMA 36451 COLLECTIONS. We Respect Your Time So Pay Online.

Assessor Revenue Commissioner and Tax Sales. For information regarding your parcel or tax account please contact the tax office in the county where your property is located. Box 6406 Dothan Al 36302 Phone Numbers.

Taxes are delinquent on January 1. Alabama delinquent property tax phone number. The median property tax in Wilcox County Alabama is 24600.

Ld-2 1095 _____ _____ _____ county code year of sale cs no. 220 2nd avenue east room 105 oneonta al 35121. Select a county below to view the tax properties that will be available at auction this year.

Once you have found a property for which you want to apply select the CS Number link to generate an online application.

Alabama Property Tax H R Block

![]()

Property Tax Jefferson County Tax Office

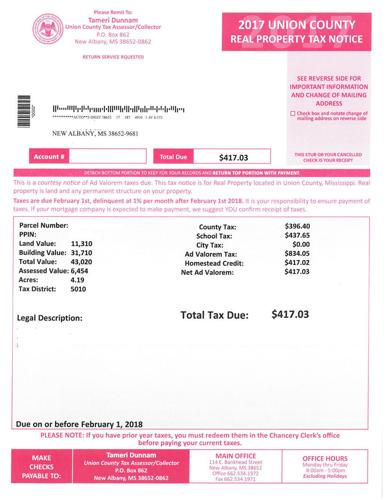

County Property Tax Bills Going Out In The Mail Soon New Albany Djournal Com

Washington State Month To Month Rental Agreement Rental Agreement Templates Being A Landlord Washington State

1311 S Central Ave Chanute Ks 66720 Chanute Little Dream Home Little Houses

Topic No 303 Checklist Of Common Errors When Preparing Your Tax Return Internal Revenue Service Tax Return Internal Revenue Service Checklist

Property Tax Alabama Department Of Revenue

Tax Delinquent Land Sales In Alabama Wholesale Home Buyers Land For Sale Real Estate Buyers Property For Sale

Chilton County Tax Collector Chilton County Alabama

County Property Tax Bills Going Out In The Mail Soon New Albany Djournal Com

Understanding Your Property Tax Bill Clackamas County

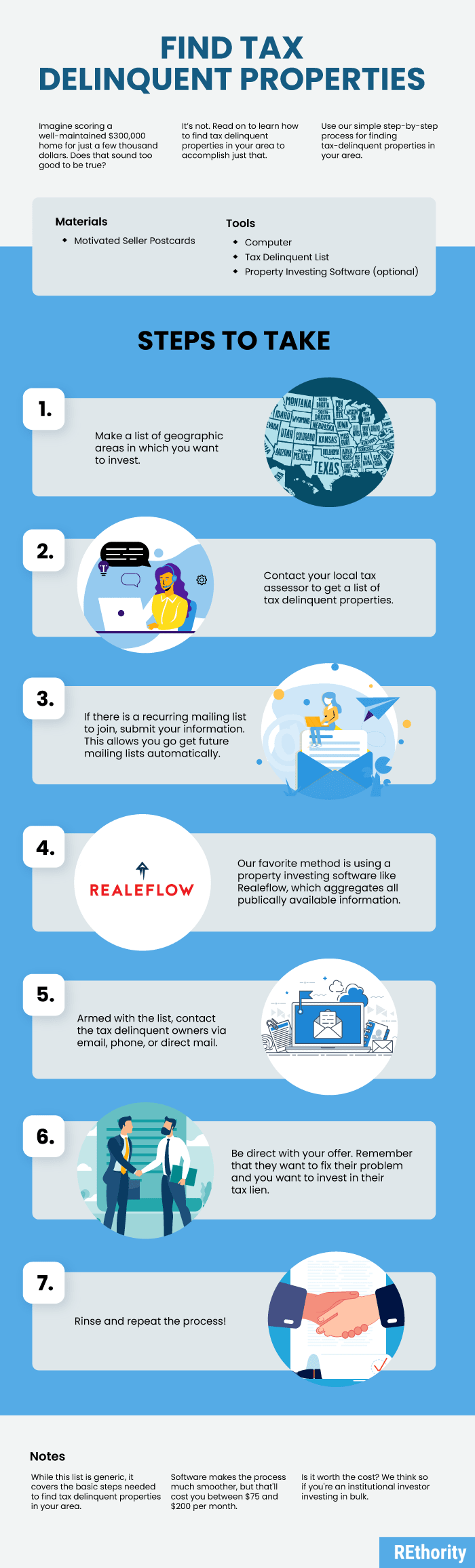

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Madison Co Tax Collector Sends Out Reminder For Property Taxes Includes New Policy For Non Payment